09.10.2020

Quel est le prix du risque à l'approche des élections américaines ?

There is no doubt that a US presidential election represents a risk for financial markets and a good way to quantify how much risk is currently priced-in is to look at the forward implied volatility before and after the elections.

For that, the VIX index, a basket of the S&P 500 options volatility, sounds a good barometer.

Looking at the VIX curve, The November expiry is currently trading 1.5% above the December one, reflecting the immediate risk investors are facing post-election (November 3rd) relative to December.

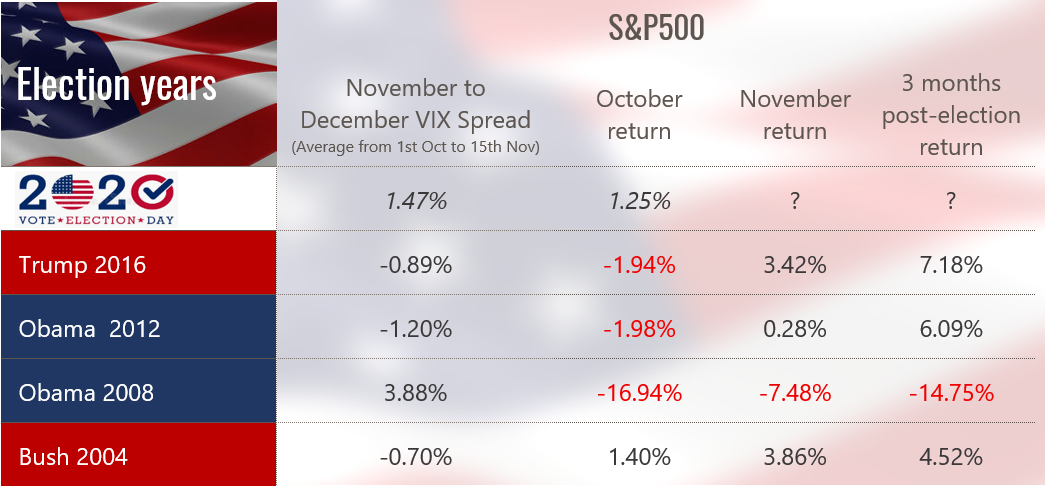

While the 1.5% spread indicates a higher implied risk around and after the election, it does not quantify the absolute level of risk. To put it in perspective, we looked at the average November-December VIX Spread from October 1st to November 15th for every US Election since 2004.

Excluding the US election during the Great Financial Crisis in 2008 where spot volatility was structurally higher than 1, 2 and 3 months forward, it appears that a positive November/December VIX Spread is somewhat unusual. In fact, during the 2004, 2012 and 2016 elections, the November VIX never traded above the December one.

Looking at the return of the S&P in October, November and 3 months after the election, we can observe that it is very difficult to draw any conclusion over a US presidential election from a financial market perspective. If anything and excluding the 2008 election during the crisis, the simple and most direct conclusion would be that a US presidential election after 2000 had a positive impact on the S&P 500 Index one month and 3 months after the outcome.

So how to explain this extra-risk this time? We believe the 1.5% premium in November volatility relative to December likely reflects one single risk: if Biden wins, President Trump might not going to accept it. A sentiment that has been reinforced after the first TV debate of the US elections.

To conclude, history shows that financial markets can easily deal with a republican or democrat president but definitely not with no President after November 4th.

Autres publications

25.02.2026

The Swiss Experience x Cité Gestion

Dans le cadre de The Swiss Experience, nous avons rencontré des praticiens du droit brésiliens à Genève afin de partager nos perspectives économiques pour 2026 et de discuter de la banque privée à travers des études de cas concrets. Cette initiative, que nous soutenons pour la troisième année consécutive, renforce les liens entre le marché brésilien et l'écosystème financier suisse tout en favorisant les partenariats stratégiques et les relations à long terme.

Lire plus18.02.2026

Intelligence artificielle : le début d'un cycle ?

L'histoire économique montre que les véritables révolutions industrielles ne se définissent pas par la technologie elle-même, mais par l'ampleur des investissements qu'elles suscitent.

Lire plus12.02.2026

Bienvenue à Reto Taborgna, Michel Ehrenhold et Stefan Müller !

Nous avons le plaisir d’annoncer l’arrivée de Reto Taborgna en tant que COO & Business Risk Manager, Michel Ehrenhold en tant que Responsable Juridique et Stefan Müller en tant que Responsable adjoint du support Private Banking chez Cité Gestion.

Lire plus09.02.2026

Forum Horizon 2026 – temps forts de l'événement

Face aux turbulences économiques globales, quel cap pour la Suisse?

Retour sur le Forum Horizon 2026, tenu le 29 janvier 2026 à l'IMD Lausanne.

Lire plus03.02.2026

Kevin Warsh à la Fed : prise de pouvoir ou rétablissement de la crédibilité ?

La nomination de Kevin Warsh au poste de président de la Réserve fédérale américaine a suscité de vives réactions sur les marchés, mais aussi de nombreux malentendus.

Lire plus26.01.2026

Bienvenue à Norma Hedinger !

Nous avons le plaisir d’annoncer l’arrivée de Norma Hedinger en tant que banquière chez Cité Gestion.

Lire plus