09.10.2020

US-Wahlen: Welche Risiken sind bereits eingepreist?

There is no doubt that a US presidential election represents a risk for financial markets and a good way to quantify how much risk is currently priced-in is to look at the forward implied volatility before and after the elections.

For that, the VIX index, a basket of the S&P 500 options volatility, sounds a good barometer.

Looking at the VIX curve, The November expiry is currently trading 1.5% above the December one, reflecting the immediate risk investors are facing post-election (November 3rd) relative to December.

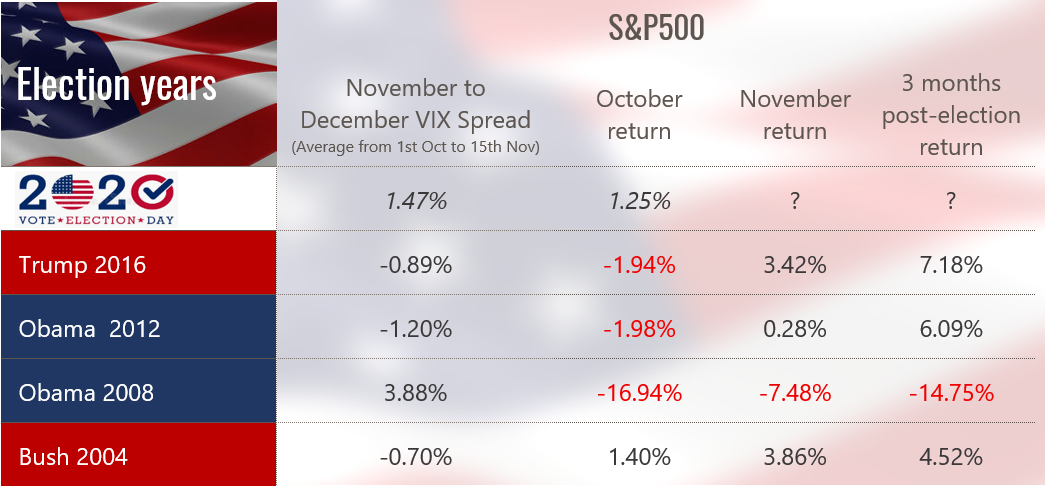

While the 1.5% spread indicates a higher implied risk around and after the election, it does not quantify the absolute level of risk. To put it in perspective, we looked at the average November-December VIX Spread from October 1st to November 15th for every US Election since 2004.

Excluding the US election during the Great Financial Crisis in 2008 where spot volatility was structurally higher than 1, 2 and 3 months forward, it appears that a positive November/December VIX Spread is somewhat unusual. In fact, during the 2004, 2012 and 2016 elections, the November VIX never traded above the December one.

Looking at the return of the S&P in October, November and 3 months after the election, we can observe that it is very difficult to draw any conclusion over a US presidential election from a financial market perspective. If anything and excluding the 2008 election during the crisis, the simple and most direct conclusion would be that a US presidential election after 2000 had a positive impact on the S&P 500 Index one month and 3 months after the outcome.

So how to explain this extra-risk this time? We believe the 1.5% premium in November volatility relative to December likely reflects one single risk: if Biden wins, President Trump might not going to accept it. A sentiment that has been reinforced after the first TV debate of the US elections.

To conclude, history shows that financial markets can easily deal with a republican or democrat president but definitely not with no President after November 4th.

Mehr Publikationen

18.02.2026

Künstliche Intelligenz: Der Beginn eines Zyklus?

Die Wirtschaftsgeschichte zeigt, dass echte industrielle Revolutionen nicht durch die Technologie selbst definiert werden, sondern durch das Ausmass der Investitionen, die sie auslösen.

Mehr dazu12.02.2026

Willkommen Reto Taborgna, Michel Ehrenhold und Stefan Müller!

Wir freuen uns, die Ernennung von Reto Taborgna zum COO & Business Risk Manager, Michel Ehrenhold zum Leiter der Rechtsabteilung und Stefan Müller zum stellvertretenden Leiter unseres Private Banking Support-Teams bekannt zu geben.

Mehr dazu09.02.2026

Forum Horizon 2026 – Höhepunkte der Veranstaltung

Angesichts der globalen wirtschaftlichen Turbulenzen: Welchen Kurs soll die Schweiz einschlagen?

Rückblick auf das Forum Horizon 2026, das am 29. Januar 2026 am IMD Lausanne stattfand.

03.02.2026

Kevin Warsh bei der Fed: Machtübernahme oder Glaubwürdigkeitswiederherstellung?

Die Nominierung von Kevin Warsh zum nächsten Vorsitzenden der US-Notenbank hat heftige Reaktionen an den Märkten ausgelöst – aber auch weit verbreitete Missverständnisse.

Mehr dazu26.01.2026

Willkommen, Norma Hedinger!

Wir freuen uns, die Ankunft von Norma Hedinger als bankerin bei Cité Gestion bekannt zu geben.

Mehr dazu21.01.2026

Künstliche Intelligenz in der Medizin: Der Wendepunkt ist da.

Vor fünf Jahren klang KI in der Medizin wie ein Versprechen. Heute wird sie zu einer Industrie.

Mehr dazu