14.12.2022

In Focus: Hedge funds – An alternative to Fixed Income or Equity?

Hedge funds – an alternative to Fixed Income or Equity?

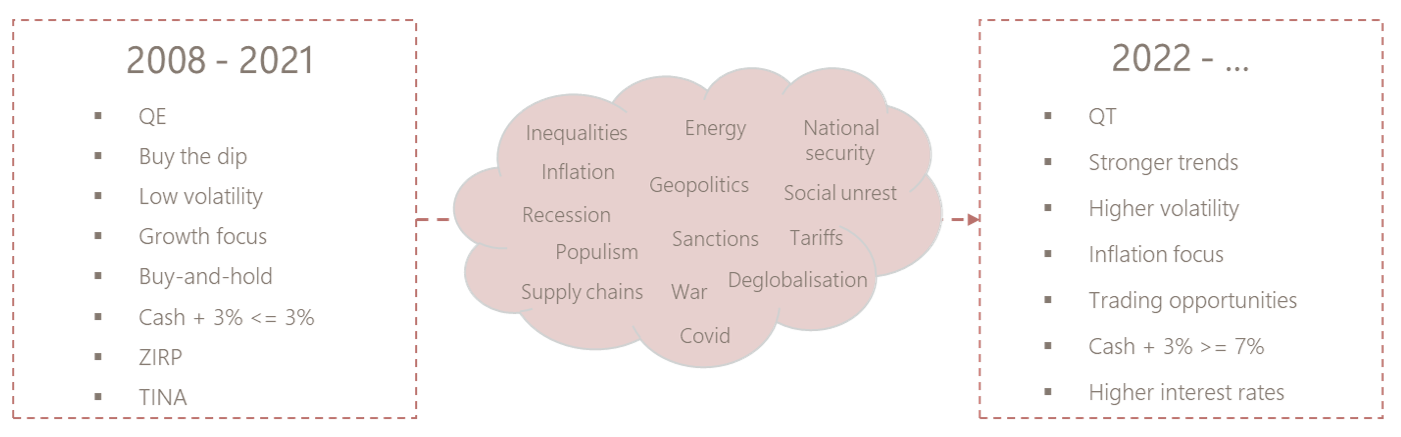

Dealing with the consequences of the global financial crisis of 2008, major central banks slashed interest rates and injected unprecedented amounts of money in the economy to save it from depression. Accordingly, interest rates reached record low levels, equity returns skyrocketed above historic averages and the negative correlation between bonds and equities made 60/40 portfolios a strategy of choice. The TINA (there is no alternative) mantra – there is no alternative to equity, and the Search for Yield prevailed. In that environment, hedge funds were used as a risk management tool, an alternative to non-yielding fixed income, at perceived high cost relative to their realised below average return.

Fast forward to today, the world has structurally changed. Interest rates are back to 2007 levels, we are witnessing the return of inflation, volatility is higher in most asset classes, and sustainable trends have allowed CTAs and macro managers to outperform. The environment is just more favourable to many hedge fund strategies, if not all of them. Higher interest rates are positive for all cash + spread strategies. Arbitrageurs have more opportunities as volatility periodically pushes price relationships out of sync. Dispersion among equities is in favour of skilled stock pickers. The re-shoring of activities, the rise of China, the rethought role of energy, climate transition and the rebalancing of geopolitical powers are a fertile ground for macro managers. Finally, the looming recession is likely to offer new opportunities for distressed managers in due time.

The next 10 years will most probably not look like the past 10 ones. Equity returns were frontloaded with the help of central banks’ quantitative easing. Going forward, quantitative tightening is likely to affect expected returns in the opposite way. In the years to come, hedge funds, particularly “uncorrelated” strategies, will continue to compete with Fixed Income for the role of “diversifier” in the portfolios, even if bonds are no longer yielding close to zero. At the same time, for the first time since global financial crisis, hedge funds have good chances to produce better returns than equities. Already this year, hedge funds proved again their usefulness in portfolios. Non-directional strategies performed the best, and we would favour those to complement multi-asset portfolios.

More articles

09.02.2026

Forum Horizon 2026 – event highlights

Faced with global economic turmoil, what course should Switzerland pursue?

A look back at the Forum Horizon 2026, held on 29 January 2026 at IMD Lausanne.

03.02.2026

Kevin Warsh at the Fed: A Power Grab or a Credibility Reset?

Kevin Warsh’s nomination as the next Chair of the Federal Reserve has triggered sharp market reactions — but also widespread misunderstandings.

Read more26.01.2026

Welcome to Norma Hedinger!

We are pleased to share the arrival of Norma Hedinger as a banker at Cité Gestion.

Read more21.01.2026

Artificial intelligence in medicine: the turning point is here.

Five years ago, AI in medicine sounded like a promise. Today, it’s becoming an industry.

Read more13.01.2026

Welcome to Raffael Iberg!

We are pleased to share the arrival of Raffael Iberg as an Investment Advisor at Cité Gestion.

Read more07.01.2026

Outlook 2026 – After the year of the 3D, welcome to the 3R Scenario!

After two exceptional years for markets, 2026 is not about euphoria - it’s about the 3R: Repricing, Rotation, and Resilience.

Read more