14.12.2022

In Focus: Hedge funds - Eine Alternative zu Fixed Income oder Aktionen?

Hedge funds – an alternative to Fixed Income or Equity?

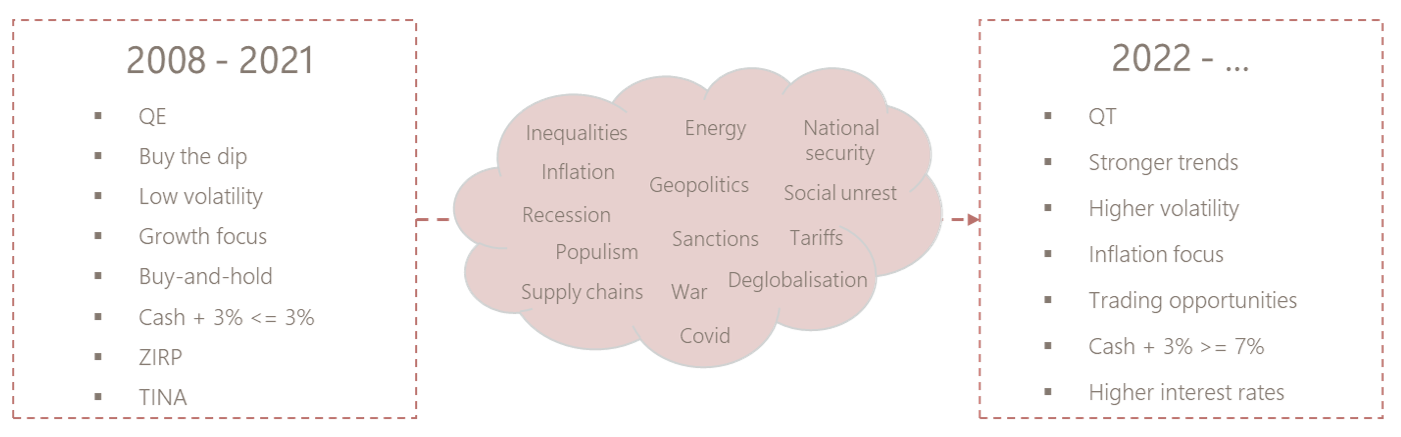

Dealing with the consequences of the global financial crisis of 2008, major central banks slashed interest rates and injected unprecedented amounts of money in the economy to save it from depression. Accordingly, interest rates reached record low levels, equity returns skyrocketed above historic averages and the negative correlation between bonds and equities made 60/40 portfolios a strategy of choice. The TINA (there is no alternative) mantra – there is no alternative to equity, and the Search for Yield prevailed. In that environment, hedge funds were used as a risk management tool, an alternative to non-yielding fixed income, at perceived high cost relative to their realised below average return.

Fast forward to today, the world has structurally changed. Interest rates are back to 2007 levels, we are witnessing the return of inflation, volatility is higher in most asset classes, and sustainable trends have allowed CTAs and macro managers to outperform. The environment is just more favourable to many hedge fund strategies, if not all of them. Higher interest rates are positive for all cash + spread strategies. Arbitrageurs have more opportunities as volatility periodically pushes price relationships out of sync. Dispersion among equities is in favour of skilled stock pickers. The re-shoring of activities, the rise of China, the rethought role of energy, climate transition and the rebalancing of geopolitical powers are a fertile ground for macro managers. Finally, the looming recession is likely to offer new opportunities for distressed managers in due time.

The next 10 years will most probably not look like the past 10 ones. Equity returns were frontloaded with the help of central banks’ quantitative easing. Going forward, quantitative tightening is likely to affect expected returns in the opposite way. In the years to come, hedge funds, particularly “uncorrelated” strategies, will continue to compete with Fixed Income for the role of “diversifier” in the portfolios, even if bonds are no longer yielding close to zero. At the same time, for the first time since global financial crisis, hedge funds have good chances to produce better returns than equities. Already this year, hedge funds proved again their usefulness in portfolios. Non-directional strategies performed the best, and we would favour those to complement multi-asset portfolios.

Mehr Publikationen

09.02.2026

Forum Horizon 2026 – Höhepunkte der Veranstaltung

Angesichts der globalen wirtschaftlichen Turbulenzen: Welchen Kurs soll die Schweiz einschlagen?

Rückblick auf das Forum Horizon 2026, das am 29. Januar 2026 am IMD Lausanne stattfand.

03.02.2026

Kevin Warsh bei der Fed: Machtübernahme oder Glaubwürdigkeitswiederherstellung?

Die Nominierung von Kevin Warsh zum nächsten Vorsitzenden der US-Notenbank hat heftige Reaktionen an den Märkten ausgelöst – aber auch weit verbreitete Missverständnisse.

Mehr dazu26.01.2026

Willkommen, Norma Hedinger!

Wir freuen uns, die Ankunft von Norma Hedinger als bankerin bei Cité Gestion bekannt zu geben.

Mehr dazu21.01.2026

Künstliche Intelligenz in der Medizin: Der Wendepunkt ist da.

Vor fünf Jahren klang KI in der Medizin wie ein Versprechen. Heute wird sie zu einer Industrie.

Mehr dazu13.01.2026

Willkommen, Raffael Iberg!

Wir freuen uns, die Ankunft von Raffael Iberg als Investment Advisor bei Cité Gestion bekannt zu geben.

Mehr dazu07.01.2026

Outlook 2026 – Nach dem Jahr der 3D: Willkommen im 3R-Szenario!

Nach zwei außergewöhnlichen Jahren für die Märkte geht es 2026 nicht um Euphorie – sondern um die 3R: Neubewertung, Rotation und Resilienz.

Mehr dazu