14.12.2022

In Focus: Hedge fund: un'alternativa al reddito fisso o all'equity?

Hedge funds – an alternative to Fixed Income or Equity?

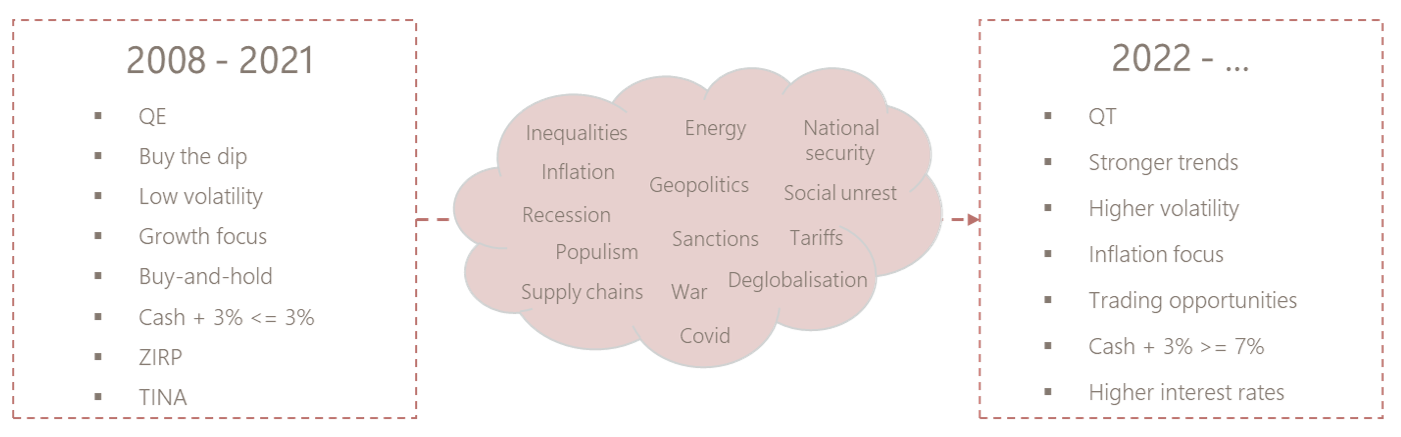

Dealing with the consequences of the global financial crisis of 2008, major central banks slashed interest rates and injected unprecedented amounts of money in the economy to save it from depression. Accordingly, interest rates reached record low levels, equity returns skyrocketed above historic averages and the negative correlation between bonds and equities made 60/40 portfolios a strategy of choice. The TINA (there is no alternative) mantra – there is no alternative to equity, and the Search for Yield prevailed. In that environment, hedge funds were used as a risk management tool, an alternative to non-yielding fixed income, at perceived high cost relative to their realised below average return.

Fast forward to today, the world has structurally changed. Interest rates are back to 2007 levels, we are witnessing the return of inflation, volatility is higher in most asset classes, and sustainable trends have allowed CTAs and macro managers to outperform. The environment is just more favourable to many hedge fund strategies, if not all of them. Higher interest rates are positive for all cash + spread strategies. Arbitrageurs have more opportunities as volatility periodically pushes price relationships out of sync. Dispersion among equities is in favour of skilled stock pickers. The re-shoring of activities, the rise of China, the rethought role of energy, climate transition and the rebalancing of geopolitical powers are a fertile ground for macro managers. Finally, the looming recession is likely to offer new opportunities for distressed managers in due time.

The next 10 years will most probably not look like the past 10 ones. Equity returns were frontloaded with the help of central banks’ quantitative easing. Going forward, quantitative tightening is likely to affect expected returns in the opposite way. In the years to come, hedge funds, particularly “uncorrelated” strategies, will continue to compete with Fixed Income for the role of “diversifier” in the portfolios, even if bonds are no longer yielding close to zero. At the same time, for the first time since global financial crisis, hedge funds have good chances to produce better returns than equities. Already this year, hedge funds proved again their usefulness in portfolios. Non-directional strategies performed the best, and we would favour those to complement multi-asset portfolios.

Altri articoli

25.02.2026

The Swiss Experience x Cité Gestion

Nell'ambito dell'iniziativa The Swiss Experience, abbiamo incontrato alcuni professionisti del settore legale brasiliano a Ginevra per condividere le nostre previsioni economiche per il 2026 e discutere di private banking attraverso casi di studio pratici. Giunta al terzo anno consecutivo, questa iniziativa rafforza i legami tra il mercato brasiliano e l'ecosistema finanziario svizzero, promuovendo al contempo partnership strategiche e relazioni a lungo termine.

Leggere tutto18.02.2026

Intelligenza artificiale: l'inizio di un ciclo?

La storia economica dimostra che le vere rivoluzioni industriali non sono definite dalla tecnologia in sé, ma dall'entità degli investimenti che generano.

Leggere tutto12.02.2026

Benvenuti a Reto Taborgna, Michel Ehrenhold e Stefan Müller!

Siamo lieti di annunciare l'arrivo di Reto Taborgna in qualità di COO & Business Risk Manager, Michel Ehrenhold in qualità di Responsabile Legale e Stefan Müller in qualità di Vice Responsabile di supporto al private banking presso Cité Gestion.

Leggere tutto09.02.2026

Forum Horizon 2026 – momenti salienti dell'evento

Di fronte alle turbolenze economiche globali, quale rotta seguire per la Svizzera?

Ritorno sul Forum Horizon 2026, tenutosi il 29 gennaio 2026 all'IMD di Losanna.

03.02.2026

Kevin Warsh alla Fed: una presa di potere o un ripristino della credibilità?

La nomina di Kevin Warsh a prossimo presidente della Federal Reserve ha suscitato reazioni violente da parte dei mercati, ma anche diffusi malintesi.

Leggere tutto26.01.2026

Benvenuto a Norma Hedinger!

Siamo lieti di annunciare l’arrivo di Norma Hedinger come banchiera presso Cité Gestion.

Leggere tutto