14.12.2022

Em Foco: Hedge funds - Uma alternativa aos títulos ou ações?

Hedge funds – an alternative to Fixed Income or Equity?

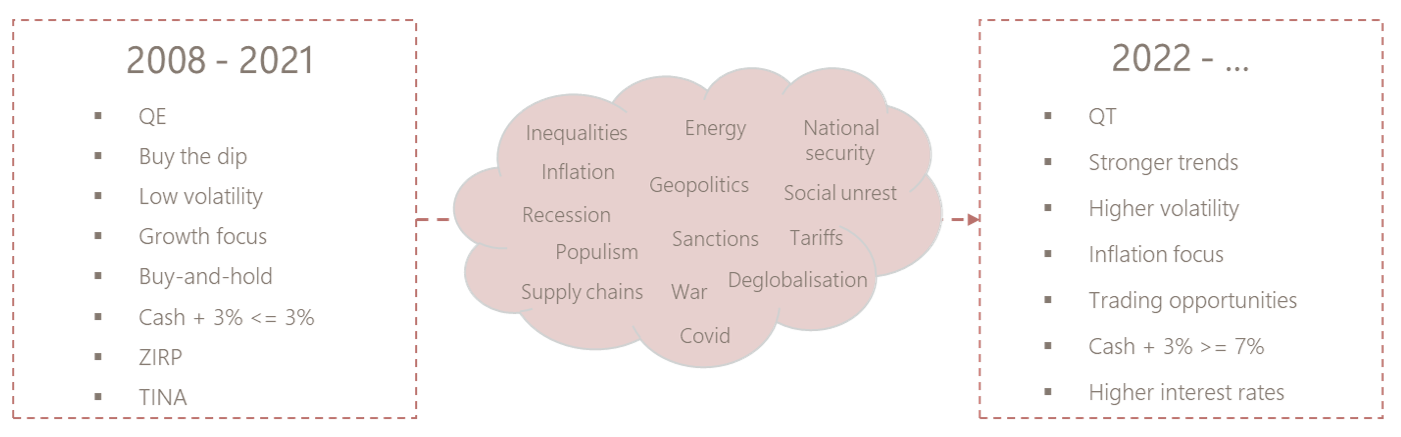

Dealing with the consequences of the global financial crisis of 2008, major central banks slashed interest rates and injected unprecedented amounts of money in the economy to save it from depression. Accordingly, interest rates reached record low levels, equity returns skyrocketed above historic averages and the negative correlation between bonds and equities made 60/40 portfolios a strategy of choice. The TINA (there is no alternative) mantra – there is no alternative to equity, and the Search for Yield prevailed. In that environment, hedge funds were used as a risk management tool, an alternative to non-yielding fixed income, at perceived high cost relative to their realised below average return.

Fast forward to today, the world has structurally changed. Interest rates are back to 2007 levels, we are witnessing the return of inflation, volatility is higher in most asset classes, and sustainable trends have allowed CTAs and macro managers to outperform. The environment is just more favourable to many hedge fund strategies, if not all of them. Higher interest rates are positive for all cash + spread strategies. Arbitrageurs have more opportunities as volatility periodically pushes price relationships out of sync. Dispersion among equities is in favour of skilled stock pickers. The re-shoring of activities, the rise of China, the rethought role of energy, climate transition and the rebalancing of geopolitical powers are a fertile ground for macro managers. Finally, the looming recession is likely to offer new opportunities for distressed managers in due time.

The next 10 years will most probably not look like the past 10 ones. Equity returns were frontloaded with the help of central banks’ quantitative easing. Going forward, quantitative tightening is likely to affect expected returns in the opposite way. In the years to come, hedge funds, particularly “uncorrelated” strategies, will continue to compete with Fixed Income for the role of “diversifier” in the portfolios, even if bonds are no longer yielding close to zero. At the same time, for the first time since global financial crisis, hedge funds have good chances to produce better returns than equities. Already this year, hedge funds proved again their usefulness in portfolios. Non-directional strategies performed the best, and we would favour those to complement multi-asset portfolios.

Mais artigos

25.02.2026

The Swiss Experience x Cité Gestion

No âmbito da Swiss Experience, nos reunimos com profissionais do direito brasileiros em Genebra para partilhar as nossas Perspectivas Econômicas para 2026 e participar em debates sobre banca privada através de estudos de casos práticos. Agora no nosso terceiro ano consecutivo de patrocínio, esta iniciativa reforça as ligações entre o mercado brasileiro e o ecossistema financeiro suíço, promovendo parcerias estratégicas e relações de longo prazo.

Leia mais18.02.2026

Inteligência artificial: o início de um ciclo?

A história econômica mostra que as verdadeiras revoluções industriais não são definidas pela tecnologia em si, mas pela escala de investimento que elas geram.

Leia mais12.02.2026

Bem-vindos, Reto Taborgna, Michel Ehrenhold e Stefan Müller!

Temos o prazer de anunciar a chegada de Reto Taborgna como COO & Business Risk Manager, Michel Ehrenhold como Responsável Jurídico e Stefan Müller como vice-diretor da nossa equipa Apoio à Banca Privada na Cité Gestion.

Leia mais09.02.2026

Fórum Horizon 2026 – destaques do evento

Diante das turbulências econômicas globais, qual rumo tomar para a Suíça?

Retrospectiva do Fórum Horizon 2026, realizado em 29 de janeiro de 2026 no IMD Lausanne.

03.02.2026

Kevin Warsh na Reserva Federal: uma tomada de poder ou uma redefinição da credibilidade?

A nomeação de Kevin Warsh como próximo presidente da Reserva Federal provocou reações acentuadas no mercado, mas também mal-entendidos generalizados.

Leia mais26.01.2026

Bem-vindo, Norma Hedinger!

Temos o prazer de anunciar a chegada de Norma Hedinger como banqueira na Cité Gestion.

Leia mais